Money markets have evolved from informal trading systems to crucial finance hubs. They play a vital role in maintaining liquidity and stability in global finance.

Money markets represent financial venues where countries, corporations, and individuals manage short-term capital needs and excess funds. Their metamorphosis from simple beginnings to the complex ecosystems we see today mirrors the broader growth of the global economy. Central to these markets are various instruments, such as treasury bills, commercial paper, and certificates of deposit, which facilitate the fluid movement of capital.

Investors and borrowers rely on these markets to quickly convert assets into cash, manage risk, and align investment horizons with specific, often short-term, financial objectives. As a keystone in the architecture of world finance, money markets offer a mechanism for financial institutions to adjust their liquidity profiles, supporting overall economic stability and growth.

Definition and Core Functions

Money markets are where entities exchange short-term loans. They cater to those needing quick cash and those with excess funds to lend. This system supports numerous core functions:

- Liquidity management for corporations and governments.

- Facilitation of capital allocation efficiently.

- A platform for central banks to implement monetary policies.

Historical Overview of Money Markets

The story of money markets dates back centuries. They began as informal networks among traders and have evolved into sophisticated platforms. Throughout history, these markets have been pivotal during financial crises, acting as buffers and channels for policy measures.

Components of Money Markets

Money markets consist of different instruments and participants. Here’s a snapshot:

| Instrument | Function |

| Treasury Bills | Government debt with maturity up to a year. |

| Commercial Paper | Corporate short-term unsecured debt. |

| Certificate of Deposit | Time deposits at banks with fixed interest. |

| Repurchase Agreements | Short-term borrowing backed by securities. |

Participants range from government treasuries to commercial banks, corporations, and money market mutual funds. All ensure that money markets operate smoothly, supporting the broader economic framework.

The Evolution Of Money Markets

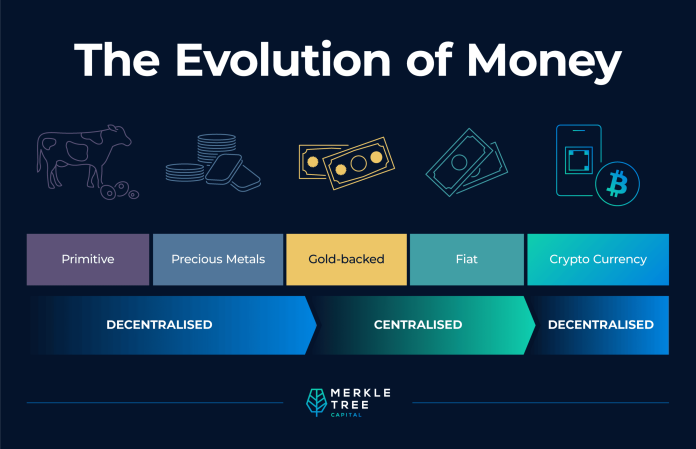

Money markets play a significant role in our lives today. Their story started long ago. Let’s see how money markets changed over time.

From Barter Systems to Coinage

In old times, people exchanged goods directly. It was bartering. Then, shiny metals became popular. These were the first coins.

The Birth of Banks And Paper Currency

Banks began to keep our metals safe. They gave us paper notes in return. We call this paper currency.

Technological Advances and Electronic Trading

- Computers changed everything.

- We started trading digitally.

- Quick and easy trades became possible.

The Rise Of Money Market Funds

Soon, we could invest without buying actual metals or products. It was thanks to money market funds.

Regulatory Changes And Effects On Money Markets

Laws changed to make trading safer. Risks went down. Markets became more trustworthy.

Money Markets in Modern Global Finance

Money markets play a pivotal role in global finance today. They provide a platform for short-term lending and borrowing, which is crucial for maintaining liquidity within the financial system. This fluidity ensures institutions and corporations can meet their immediate monetary needs smoothly.

The Role of Money Markets In The Financial System

Money markets act as the lifeblood of the financial system. They ensure cash availability by offering a variety of short-term financial instruments, like Treasury bills and commercial paper. This constant flow aids day-to-day operations and facilitates economic health.

Interbank Lending and Central Bank Policies

- Banks lend to each other to manage liquidity.

- Interest rates influence borrowing costs.

- Central banks steer economic policy through market interventions.

Short-term Financing For Corporations

Corporations rely on money markets for quick funding. These markets offer secure and efficient ways to obtain short-term loans, thus supporting business operations and enabling growth without disrupting long-term planning.

The Impact of Money Markets On Economic Stability

A stable money market reduces financial volatility. It provides a buffer during economic uncertainty. Money markets help maintains balance in the global financial landscape by offering safe investment options.

International Money Markets and Currency Exchange

- Facilitate global trade and investment.

- Allow efficient currency conversion for international dealings.

- Influence exchange rates and overall economic activity.

Challenges and The Future Of Money Markets

Imagine a world where every transaction, every investment, and every saving choice adapts to the rapid pace of technological change. The money markets, an essential part of global finance, face this reality. As they evolve, they encounter diverse challenges and an unpredictable future.

The 2008 Financial Crisis and Its Aftermath

Over a decade ago, the financial world was rocked by a crisis. This 2008 meltdown reshaped money markets, enforcing stricter regulations for better financial stability. It introduced new rules aimed at protecting investors and preventing another crash. Financial institutions had to rethink strategies, and compliance became the new buzzword in banking circles.

Current Trends and Innovations in Money Markets

Technology is driving transformation in money markets. Mobile apps allow easy access for users to trade and save. Fintech companies are creating competitive alternatives to traditional banking services. These innovations promise convenience but require new skills from market players to adapt and thrive.

Potential Risks and Future Developments

With new tech come new challenges. The money markets must navigate a maze of cyber threats, technological disruptions, and regulatory hurdles. Experts predict AI and machine learning will play significant roles, automating complex tasks and leading to groundbreaking financial instruments.

The Role of Crypto and Decentralized Finance (defi) In Money Markets

Decentralized finance is a game-changer. Its entry into money markets may offer freedom from traditional banking constraints. Cryptocurrencies and blockchain technologies promise more open and transparent transactions. Nonetheless, they come with their own set of risks and regulatory challenges that must be navigated wisely.

Conclusion

Money markets have indeed transformed the financial landscape, adapting to the ebb and flow of global finance. Their growth mirrors the complexity and interconnectedness of today’s economies. As investors and policymakers navigate this terrain, understanding money markets remains crucial. Embracing their evolution can offer insights into future financial stability and progress.