In modern economies, bankers play a vital role in economic development. As financial intermediaries, banks and their professionals stand at the crossroads of capital flows, channeling funds from savers to investors, entrepreneurs, and individuals needing credit. In this comprehensive exploration, we delve into how bankers act as catalysts to economic growth, the importance of financial services in development, and the impact of banking activities on various sectors.

Fundamentals of Banking in Economic Development

The banking sector is often referred to as the lifeblood of an economy for several compelling reasons:

- Provision of Credit for Businesses and Consumers

- Mobilization of Savings for Investment

- Facilitating Trade and Commerce through Financial Services

- Supporting National Projects and Infrastructure Development

Credit Provision and Entrepreneurship

Credit plays a fundamental role in the growth of economies by enabling consumers to purchase goods and entrepreneurs to invest in new ventures. Bankers are at the forefront of credit provision:

- They assess creditworthiness and allocate loans.

- They manage risks associated with lending.

- They offer advice and financial products to support business plans.

Bankers as Intermediaries and Advisors

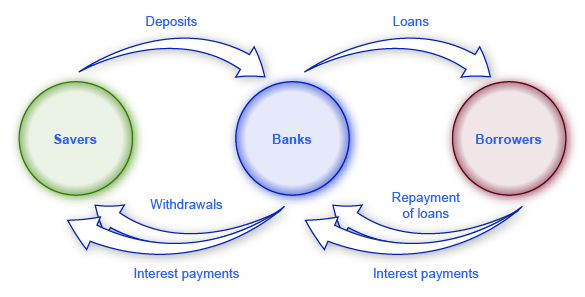

Beyond just lending, bankers perform intermediary services essential to economic stability and growth. They match savers with investment opportunities, ensuring that excess funds are effectively translated into productive activities. Moreover, bankers often take an advisory role, helping clients navigate the complexities of financial planning and investment. It includes:

- Investment and wealth management services

- Retirement planning and savings strategies

- Insurance and risk assessment

Economic Indicators and the Banking Sector

The health and activities of the banking sector can serve as significant economic indicators. Here’s an overview of how these indicators reflect the role of bankers in economic development:

| Economic Indicator | Banking Sector’s Role |

| Gross Domestic Product (GDP) | Loans and credit facilities boost business operations, directly influencing GDP growth. |

| Inflation Rates | Banking policies, including interest rate adjustments, can help control inflation. |

| Unemployment Rates | Access to credit fosters new businesses, which in turn create employment opportunities. |

| Foreign Direct Investment (FDI) | Banks facilitate international transactions and can attract FDI through robust financial services. |

Innovation and Technology in Banking

Integrating innovation and technology in banking streamlines operations and opens up new avenues for economic development. Bankers play a crucial role in adopting and implementing these advancements:

- Digital banking platforms increase accessibility and reduce transaction costs.

- Fintech collaborations expand the reach of financial services to the unbanked populations.

- Data analytics and AI improve risk assessment and customer personalization.

Bankers Influence Economic in Several Ways

Bankers play a critical and influential role in economic development by acting as intermediaries between savers and borrowers. They facilitate the flow of funds in the economy, contributing to the efficient allocation of resources, fostering economic growth, and promoting financial stability. There are several ways in which bankers influence economic development:

- Capital Mobilization:

Banks gather funds from depositors and investors, pooling resources for productive use. This capital mobilization is essential for financing various economic activities, including business expansions, infrastructure projects, and entrepreneurial ventures.

2. Credit Allocation:

Bankers assess creditworthiness and allocate funds to borrowers based on their ability to generate returns. This allocation helps direct capital to sectors with growth potential, supporting the development of industries and businesses that contribute to economic expansion.

3. Financial Intermediation:

Banks act as intermediaries between savers and borrowers, channeling funds from those with a surplus to those with a deficit. This process ensures funds are directed towards productive investment, promoting overall economic development.

4. Risk Management:

Banks play a crucial role in managing and mitigating financial risks. Through carefully evaluating loan applicants and diversifying their portfolios, bankers contribute to financial stability and resilience, preventing systemic failures that could impede economic development.

5. Payment System Facilitation:

Banks provide a secure and efficient payment system, which is fundamental for economic transactions. Electronic fund transfers, checks, and other payment mechanisms offered by banks contribute to the smooth functioning of the economy.

6. Financial Inclusion:

Bankers can play a role in promoting financial inclusion by expanding access to banking services. By reaching out to underserved populations, banks can help individuals and small businesses access financial resources, fostering inclusive economic growth.

7. Currency Management:

Central banks, a subset of the banking sector, manage the nation’s currency and implement monetary policies. These policies influence inflation, interest rates, and overall economic stability, impacting investment decisions and economic growth.

8. Technology and Innovation:

Banks often drive technological advancements in the financial sector, introducing innovations such as online banking, mobile payments, and blockchain technology. These innovations enhance efficiency, reduce transaction costs, and promote economic development.

9. Foreign Exchange Operations:

Banks facilitate international trade by providing foreign exchange services. It enables businesses to engage in cross-border transactions, fostering economic integration and globalization.

10. Infrastructure Financing:

Banks often play a crucial role in financing major infrastructure projects like highways, airports, and energy facilities. This infrastructure is critical for economic development as it enhances productivity and connectivity.

In summary, through their various roles and functions, bankers contribute significantly to economic development by mobilizing and allocating capital, managing risks, facilitating financial transactions, promoting innovation, and supporting infrastructure projects.